Fixed assets (in Business Central, you will often find the abbreviation ‘FA’) are, simply put, the long-term assets that a company owns and uses for business purposes. They can be divided into:

Intangible, e.g., software

Tangible, e.g., buildings, equipment (computers, monitors, etc.), machinery, vehicles, furniture

In other words, fixed assets are company-owned items that are not for sale within 12 months. There are different tax obligations and regulations regarding fixed assets (FA) depending on the country. In some cases, to qualify as an asset, the value must be higher than a certain amount, while in others, only part of the fixed asset can be included in taxable costs. A fixed asset (FA) can be depreciated differently according to local regulations and differently for the group (when multiple companies have the same owner and follow consistent financial rules). In this article, we will mainly focus on the basic postings for an asset using a single depreciation book.

The main parts of the lifecycle of a fixed asset (FA) are:

Purchase

Depreciation

Disposal

During its lifecycle, there may be unexpected situations, and our FA can be:

Appreciated

Written down

Below, you can follow each step separately.

To start working with fixed assets, you need to begin with the Fixed Assets Setup:

Default Depreciation Book – as shown above, one company can have multiple depreciation books. This means that a fixed asset (FA) can be depreciated in different ways (later we will discuss the different types). To avoid creating multiple cards for different types, you can assign different books to a single asset. You must create at least one Depreciation Book for the company.

For basic posting, let’s keep the "Allow FA Posting" field open (meaning do not fill it in).

At the end, assign the Fixed Asset Nos. If you do not set it, then you must fill in the number of the asset manually.

Fixed Asset Card:

To start working on Fixed Assets all of them needs a Card:

No.: The next number from the series or a manually added unique value.

Description: Information about the asset.

You can assign an FA Class and FA Subclass Code—this helps divide the assets into different types. For a more advanced setup, you can assign a default FA Posting Group (we will explain this setup in more detail later).

Purchase

There are three ways to acquire Fixed Assets:

Select the Fixed Asset on the Purchase Invoice.

Create a Fixed Assets G/L Journals

Create Fixed Assets Journals (we will not focus on this option in this article, as it is primarily used for additional depreciation books.)

Before proceeding with the posting, let’s locate the accounts that the system will use for subsequent postings. Navigate to FA Posting Groups to find this information.

Code: Create different Fixed Asset Groups. These groups are typically linked to the corresponding Fixed Assets accounts in the Chart of Accounts.

Acquisition Cost Account: This is the account where the value of the purchased asset is posted. Later, this value will be used to calculate depreciation. The initial depreciation amount may include multiple postings (as explained in the section about Fixed Assets under construction). As noted in the article (...), the cost of the purchase will be posted on the debit side.

Please remember that the account selected as the Acquisition Cost Account must have all Product Posting Groups assigned on the G/L Card.

Otherwise, you will encounter an error when attempting to select it.

First method of posting, post the values directly to the Fixed Asset Card and the General Ledger Entries.

When creating a Purchase Order/Invoice, fill in the following details on the lines:

Type: Fixed Asset

No.: Select the Fixed Asset Card created earlier

Quantity: 1

Direct Unit Cost Excl. VAT: Enter the net value from the purchase document

FA Posting Type: Acquisition Cost

The outcome can be viewed in the General Ledger Entries and on the Fixed Asset Card.

In the General Ledger Entries, you can see the account from the setup mentioned above, with the value posted on the debit side.

On the Fixed Asset Card, you can see the Book Value, and in the FA Ledger Entries, you will find the value labeled as Acquisition Costs.

The second method involves posting the Purchase Order/Invoice to an interim account, then posting the Fixed Assets G/L Journals. By "interim account," we mean an account used as a "transit account." This account temporarily holds the value until we transfer it in the second step to the appropriate Fixed Assets account.

Post the Purchase Order/Invoice and select the interim account on the lines:

Type: G/L Account

No.: Select the interim account

Quantity: 1

Direct Unit Cost Excl. VAT: Enter the net value from the purchase document

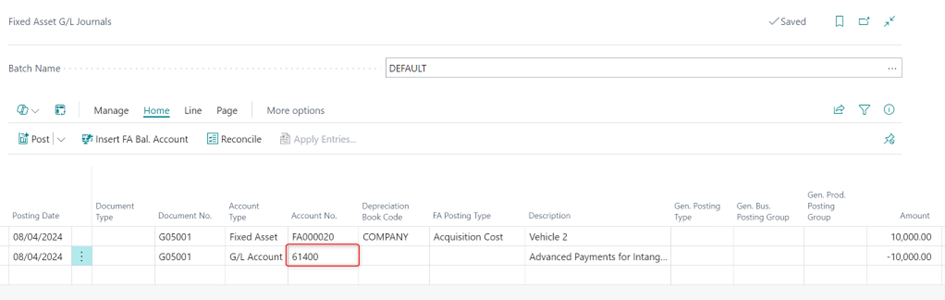

Next, open the Fixed Asset G/L Journal and fill in the following details:

Account Type: Fixed Asset

Account No.: The Fixed Asset Card

Depreciation Book: Company

FA Posting Type: Acquisition Cost

Amount: The same value used in the purchase document

For clarity, the offsetting account is added as a second line, but you can also use the Bal. Account Type and Bal. Account No. fields instead:

Account Type: G/L Account

Account No.: The account from the purchase document

Amount: On the line above, we have a credit value, so here we must enter a negative amount (credit). This must also be a credit, as we need to offset the value from the G/L Account. Since the purchase document was a debit, we need a credit entry here.

The outcome after posting is visible on the Fixed Asset Card as Book Value, and in the General Ledger Entries, but in two steps.

On the Posted Invoice only the Geneal Ledger Entry is created:

Next, navigate to the General Ledger Entries for the interim account, where you can see the value posted in with the invoice and out with the journal.

Note: After posting the transaction, the balance must be 0.

On the Fixed Asset Card and in the FA Ledger Entries, you can see the values posted by the journal.

The third option relates to the integration of Fixed Assets (FA) with the General Ledger (G/L). On the Depreciation Book Card, you can choose whether postings will be made directly to the G/L from the FA module. If there is no integration, the FA will be posted separately to the G/L and the FA Card.

This setup is often used for additional depreciation books. For example, a company may have a group book that records all fixed asset transactions solely for reporting purposes.

Depreciation

Each Fixed Asset loses value over time due to usage. This decrease in value is calculated and deducted from the acquisition value over a period of time. This process is called depreciation. There are several methods for calculating depreciation, but the posting will look the same—the only difference will be the value.

To select the accounts used for depreciation, you must return to the FA Posting Group:

Accum. Depreciation Account – the account from which you deduct the value from the FA Book Value.

Depreciation Expense Account – the account representing the cost of using the fixed asset.

To calculate depreciation, use the action on the Fixed Asset List: Calculate Depreciation.

To create a simple calculation, you can add the Use Force No. of Days. The system will then calculate the number of days provided in the setup on the line below (Force No. of Days). To simplify your work, check Insert Bal. Account so you won’t need to type it manually.

The posting will be processed through the Fixed Asset G/L Journals:

As we can see in the journal, the value that decreases the fixed asset is credited. On the debit side, we have the cost of using the asset (depreciation).

You can see it on the FA Ledger Entries:

Disposal / Sales

Sometimes, you need to sell your fixed asset because you no longer need the machine or other property. You can simply issue a sales invoice to dispose of your asset. First, the necessary setup needs to be completed.

Acq. Cost Acc. On Disposal – The reversal of the acquisition cost will be posted to this account.

Accum. Depr. Acc. On Disposal – The reversal of the accumulated depreciation will be posted to this account.

Gains / Loss Acc. On Disposal – The profit or loss from the sale will be posted to this account.

Create the Sales Invoice:

Account Type: Fixed asset

Account No.: Number of the Fixed Asset

Quantity: 1

Amount: the amount

After posting, you can see the entries that have been created.

On the first line, you can see the receivables from the clients. The next two lines represent the reversal of the acquisition cost (credit) and cumulative depreciation (debit). Finally, you can see the gain or loss received on the disposal of the fixed asset (FA).

On the FA card, it is represented as follows:

In the Depreciation Book Card, you can decide if the asset will be disposed of as Net or Gross. If so, additional setup in the FA Posting Group will be needed. This will be covered in later articles.

Appreciation

When you increase the value of your fixed assets by adding additional value, it is called appreciation. The most common situation occurs when you repair or add spare parts to your asset, thereby increasing its value. In most cases, this involves an invoice. The posting looks similar to the acquisition process we discussed in Purchasing of the FA. The FA Posting Type is Appreciation then.

First, you must select the Appreciation account in the FA Posting Groups.

The posting is going through the interim account:

When you create the Fixed Asset G/L Journal, you must select the FA Posting Type: Appreciation. The opposite G/L account must be the same as the one on the invoice.

The outcome of the posting can be viewed on the FA Card (Book Value), FA Ledger Entries, and G/L Ledger Entries (reflecting the appreciation account from the FA Posting Groups).

During the posting of the journal, you credited the interim account to balance it to zero, and on the other side, debited the total value of the assets.

The correction of the sales/disposal will be covered in a following article.

NOTE: Before proceeding with the sales/disposal, make sure to first calculate the depreciation.

Written down

A write-down is the opposite of appreciation. Let’s assume that our asset was damaged. After repairing it, the asset is worth less on the market than its value in our books. We must adjust the value of the asset to reflect its current value.

First, set up the Write-down account in the FA Posting Group. The system will use this account to record the decreased value of the asset.

Then, when you create the journal, select the FA Posting Type: Write-Down, and for the opposite account, add the cost account where the loss in value of the asset will be recorded.

You can see the changes on the FA Card and FA Ledger Entries.

On the cost account, we can see the G/L Ledger Entries.

This is just the first basic information about assets. In future articles, we will cover more complex issues related to them!

Thanks for checking!

Commenti